In June 2024, Rakuten Trade Malaysia launched Raku-Invest, a Regular Savings Plan (RSP) for stocks and ETFs. This program provides Malaysians with a convenient opportunity to invest in the US stock market, minimizing the impact of market volatility. From my personal experience with manual investments, I often hesitated to buy shares during months when prices fluctuated drastically. Raku-Invest removes this emotional barrier by enabling consistent, automated investments.

To validate the concept that consistent investment is one of the best ways to build wealth, I initiated a real-life portfolio. This portfolio focuses exclusively on ETFs (Exchange Traded Funds), which provide diversification by representing a basket of shares. I named it the Auto-Investment Portfolio, a straightforward name for a systematic approach. Over the next 2-3 years, I’ll track its performance and share my findings.

(Source: Pixabay; Created by Viarami)

Selection of ETFs

For broader market exposure, I started with the following ETFs:

US Growth Stocks: Schwab U.S. Large-Cap Growth ETF (SCHG)

US Value Stocks: Vanguard Value ETF (VTV)

US High Dividend Stocks: Vanguard High Dividend Yield ETF (VYM)

Emerging Markets: Vanguard FTSE Emerging Markets ETF (VWO)

China Market: iShares China ETF (MCHI)

In July 2024, I added the JPMorgan Nasdaq Equity Premium Income ETF (JEPQ) to the portfolio. This ETF offers a high dividend yield (approximately 9% before tax). However, given the 30% withholding tax for non-US citizens, many investment experts advise caution with high-dividend investments.

By November 2024, I diversified further by including these sector-specific ETFs:

Gold: SPDR Gold MiniShares Trust (GLDM)

Technology: SPDR Technology Select Sector ETF (XLK)

Energy: SPDR Energy Select Sector ETF (XLE)

I chose not to rebalance the portfolio, aiming instead to let well-performing ETFs continue generating returns. Underperforming ETFs may eventually be swapped for others.

Portfolio Performance Since June 2024

All investments were made using Malaysian Ringgit (MYR), and the performance accounts for brokerage fees and charges. Updates on returns are provided bi-monthly.

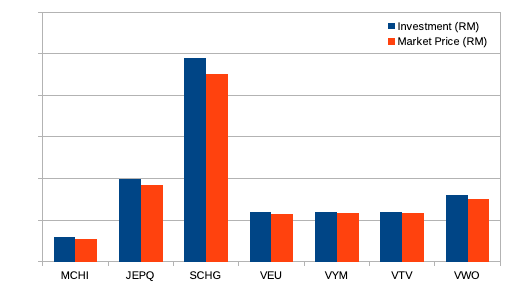

August 2024

The portfolio’s launch coincided with a mini market peak, followed by a decline across all ETFs. By August, the portfolio showed a return of -8%. Despite this, I remained committed to consistent investing, undeterred by market volatility.

October 2024

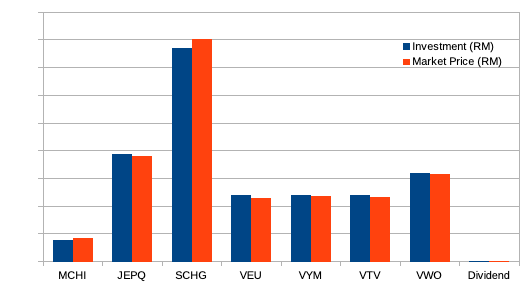

By October, the portfolio’s value rebounded and broke even. Notable developments included:

The Chinese government’s economic initiatives boosted the China ETF (MCHI) by +7%.

Improved performance of the Schwab U.S. Large-Cap Growth ETF (SCHG), driven by the “Magnificent Seven” tech stocks, leading to a +4% gain from an earlier -8% loss.

To reduce costs, I consolidated some regular investments, taking advantage of Rakuten Trade’s flat RM1 platform fee per transaction. Dividend income began trickling in, with JEPQ paying monthly and other ETFs quarterly. These dividends were reinvested in certain ETF’s.

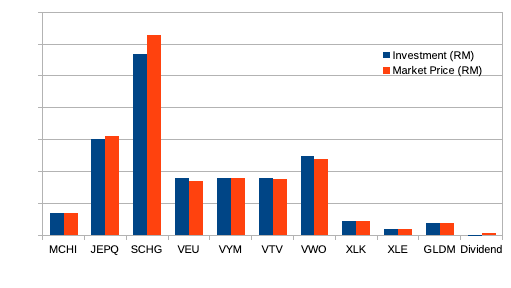

December 2024

The U.S. presidential election results caused emerging markets, including China (MCHI), to underperform. Despite this, SCHG continued to excel, gaining 10% since July, possibly due to year-end “window dressing” by fund managers. Value and dividend-focused ETFs (VTV and VYM) lagged behind.

The three new ETFs added in December (XLE, XLK, GLDM) showed minor losses initially but are expected to stabilize over time.

Looking Ahead

As we step into 2025, I’m optimistic about the long-term growth of this portfolio. Over the coming months, I plan to:

Monitor and document the performance of individual ETFs.

Assess the impact of dividends on overall returns.

Evaluate the potential need for adjustments to the portfolio based on market trends.

Optimize the investment frequency in a month.

By maintaining focus on long-term goals, I hope to demonstrate that wealth-building through consistent investment is achievable. Let’s keep tracking and learning from this journey together. If you’re considering starting your own investment journey, now might be the perfect time to explore programs like Raku-Invest!